Planned Giving

Gifts from Retirement Plans

Your retirement-plan benefits are very likely a significant portion of your net worth. And because of special tax considerations, they could make an excellent choice for funding a charitable gift.

Retirement-plan benefits include assets held in individual retirement accounts (IRAs), 401(k) plans, profit-sharing plans, Keogh plans, and 403(b) plans.

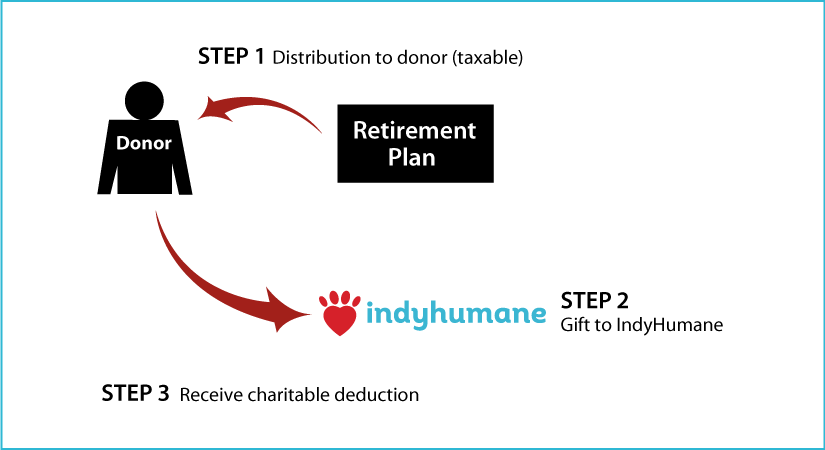

Lifetime Gifts  Click to See Diagram |

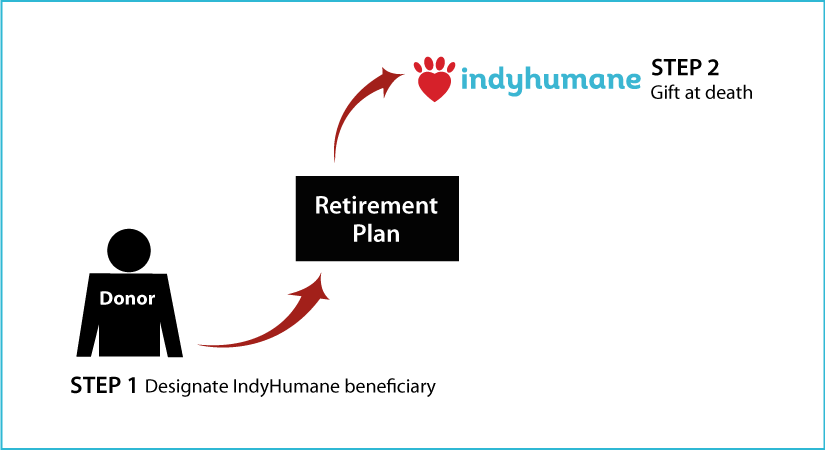

Estate Gifts  Click to See Diagram |

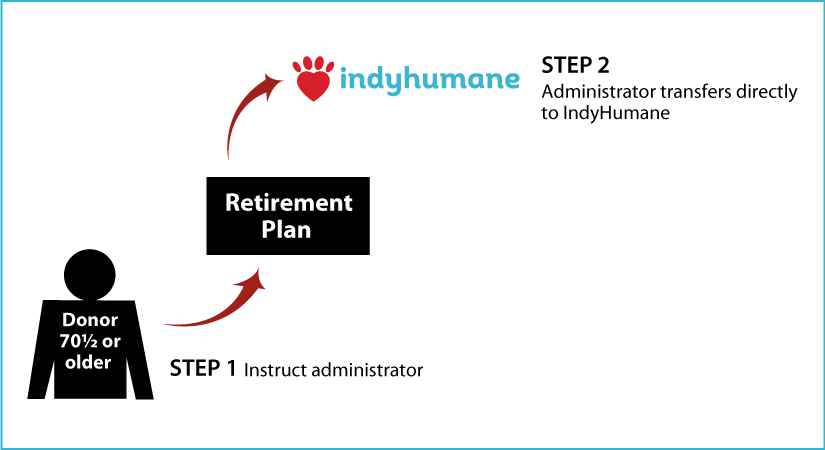

“IRA Rollover” Gifts (QCD)

Read More

Beneficiary Designations

For additional assets not covered in your will, including (but not limited to): 401ks, IRAs, Life Insurance Policies, and Bank Accounts, you must designate a beneficiary. If you would like to name the Humane Society of Indianapolis (IndyHumane) as your beneficiary, you can use this online tool to help organize your accounts and name beneficiaries.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer